If the pandemic didn’t impact our finances enough, Victorian rental scams are spiking thanks to individuals capitalising on the latest round of lockdowns.

In comparison to previous years, the Australian Financial Complaints Authority (AFCA) has reported a sharp rise in consumer complaints regarding financial scams. After receiving more than 11,000 complaints related to COVID-19 in the year leading up to the anniversary of the pandemic’s declaration, AFCA has also reported a 23% jump in the monthly average of complaints about unauthorised transactions and scams in the six months to December 31.

While common financial scams reported in Australia include phishing for personal information, online shopping, and superannuation scams, the Australian Securities and Investments Commission (ASIC) has also reported an increase in the number of investment scams reported by consumers over the course of the global pandemic, with some quarterly periods recording increases of as high as 20%.

Of course, nobody willingly falls victim to financial scams – but ongoing lockdowns and economic uncertainty has created the perfect storm for fraudulent activity, and Victorian rental scams are unfortunately no exception.

Understanding Common Victorian Rental Scams

As of September 2021, Victorians are currently permitted to leave their homes for just a handful of reasons, including shopping for food and supplies, authorised work and study, care and caregiving, getting vaccinated, and outdoor recreation in line with current restrictions. In-person auctions and inspections were banned for months, with only virtual ones allowed to take place.

However, when it comes to spotting common Victorian rental scams, one of the most useful pieces of advice given to avoid falling victim is to ensure that you physically inspect the property in question before handing over any funds. While the restrictions on physical property inspections have since been lifted, many private landlords are still opting to avoid inspections for the near future.

Unfortunately, scammers have more than capitalised on this fact. Just like reputable real estates with real properties up for rent, unsavoury characters have been known to advertise rental properties on well-known property websites and conduct virtual inspections with potential tenants. Even though they have no right to rent it to you, scammers may show you through a property, and provide photo identification of themselves, lease agreements, real physical addresses and even land title deeds as a means to appear genuine.

Essentially Victorian rental scams go for the jugular via two methods. Firstly, scammers conduct financial crime by asking for a month’s bond and rent to secure the property. This is usually done through a bank transfer, which has very little chance of recovery. Secondly, scammers may also ask for personal details used for phishing purposes, such as photo identification and the information found on your lease agreement, which they can then use for credit card and identity fraud. It’s only when the victims are unable to contact the scammer that the alarm bells usually start to ring.

Unfortunately, ESPA director Luke Lawlor is very familiar with Victorian rental scams. Although scenarios such as the above have been recently documented in Traralgon, Shepparton and Echuca, metropolitan Melbourne is not exempt to this form of financial crime either.

“Just last week, a member of our ESPA business network fell victim to a rental scam targeting renters in Brunswick and Fitzroy. Upon becoming suspicious and contacting Moreland Police, she discovered that the scammer had accumulated more than twelve victims in just three short weeks in line with Melbourne’s latest lockdown. While the young lady has a lot of experience in renting properties both domestically and internationally, it goes to show that almost anyone can fall victim to fraudulent activities like this, especially when they are becoming increasingly difficult to identify. ”

As such, if the scammers in question are getting smarter, what can renters do to avoid falling into a financial trap? Although tenants may be restricted to virtual inspections and unable to follow the usual protocols, there is still plenty of relevant advice to follow even in a lockdown.

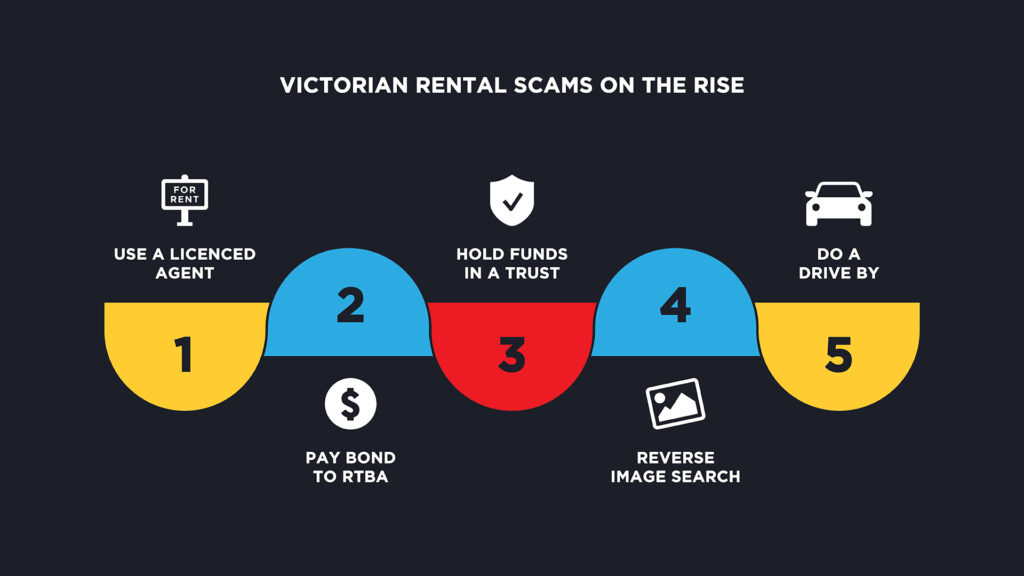

Use A Licenced Agent – Although private rental agreements sourced via Facebook and Gumtree can be appealing due to their often all inclusive nature and cheaper price point, be extra cautious of these listings as they offer less protection to tenants when compared to a licenced and registered real estate agency.

Pay Bond To RTBA – If you are paying a bond for a Victorian property, try to pay via a money order or bank cheque made out to the Residential Tenancy Bond Authority (RTBA). In the event that you do fall victim to one of the many Victorian rental scams, this helps to minimise the amount of funds lost.

Hold Funds In A Trust – For those dealing with a private rental, ask to hold your funds in a trust account until you receive the keys. A trust account is a legal arrangement where assets are held by a third-party on behalf of another party. The trust beneficiary can be a group or an individual, and the assets can be anything of value, such as cash, real estate, stocks, and even jewellery.

Reverse Image Search – Scammers can steal photos and ads from legitimate real estates or rental sites. As such, do an internet search with images from the advertising, to check they haven’t been copied from another site. Image search websites such as Google images or TinEye will allow you to comb the internet with photos, not just text.

Do A Drive By – Although this can be tricky if you’re considering an application for a flat or unit, if you’re looking at renting a house, don’t be afraid to drive past the property in question. While it may not solve all of your queries, try to have a chat with the current resident if you see them in the yard out front or knock on their door to verify that the advertised conditions are legitimate.

Victoria’s peak real estate body had long been calling for one-on-one private inspections to be permitted during lockdowns until vaccination targets are met. Real Estate Institute Of Victoria chief executive Gil King said that buyers and renters were “flying blind” trying to purchase homes or secure leases without inspecting a property in person.

“Lockdown regulations that ban property inspection by private appointment are creating an unnecessary burden on the property market, impacting aspiring homeowners and mum and dad investors. Most critically, though, they’re stopping many people from being able to access rental properties so they can put a roof over their heads,” Mr King said. With the inevitability of more snap lockdowns until a Covid-19 vaccination target is reached, the REIV, on behalf of the property sector, is calling on the Victorian Government to remove this unnecessary and onerous restriction and allow the sector to get on with essential business.”

While the in person inspections have now been permitted again with strict protocols, following the above advice and tips can help to ensure that renting a property in Victoria doesn’t have to be any more stressful or costly than it needs to be.

Take The Stress Out Of Selling Property

A completely free service, Emergency Services Property Advisors provide property advisor services to Police, Fire, Ambulance and S.E.S personnel and their families right across Victoria.

Luke and the team at ESPA are passionate about providing support to some of Australia’s most valued public servants. Along with key industry insights, ESPA also works with a broad range of service providers linked to the real estate industry such as conveyancers, trades, legal practitioners and mortgage brokers.

If you are an emergency services worker looking to potentially buy or sell property in the future, please get in touch with Emergency Services Property Advisors today to discuss how we can turn your real estate dreams into reality, or call Luke directly on 0414 757 705.