If you’ve outgrown your current home, the next step is selling to upsize. However, there’s a few factors to consider when it comes to buying a bigger abode.

While bigger isn’t always better, Australians make the conscious decision to increase the size of their abode for a wide variety of reasons: a growing family, upgrading from their first home purchase, or even just the desire for a nicer, newer and larger property. However, making the choice to upsize shouldn’t be a decision made lightly, as a bigger home often attracts a bigger mortgage.

The funds at your disposal will often influence whether upsizing is a good idea or not. It’s important to factor in the usual costs associated with selling property, what the property market forecast looks like, plus how you plan to finance your upgrade. As such, before you dive into listing your current house for sale, be sure to consider the following first.

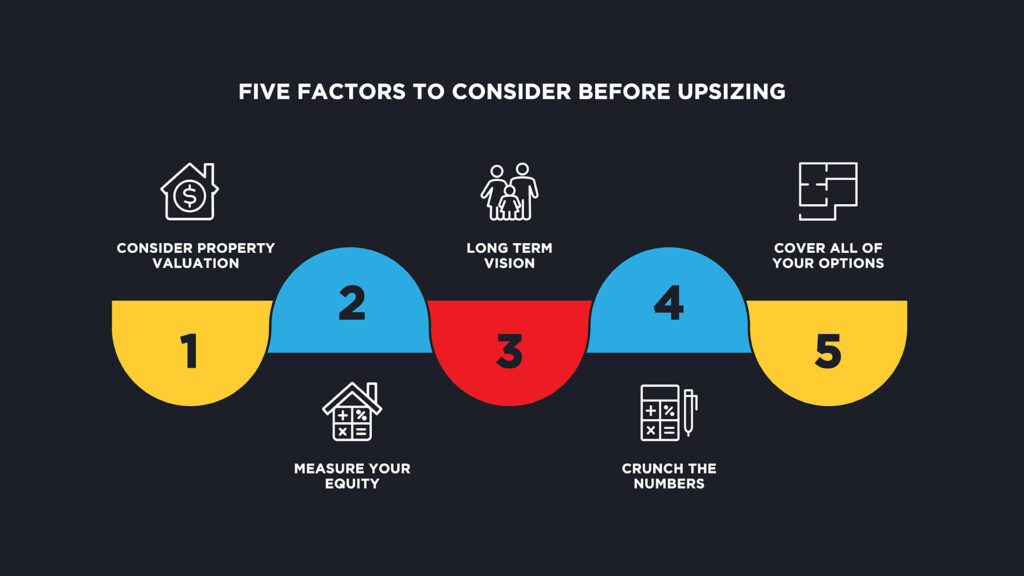

Five Factors To Consider Before Upsizing

From accurately estimating the true cost of selling a home all the way through to exiting an existing mortgage, it can be difficult to know where to start in the world of selling property. However, before you make the decision to do so as a means to upsize, be sure to tackle the following conundrums first.

Consider Property Valuation – Undertaking a property valuation is usually a task required of property owners, real estate agents and investors, and is a detailed report on a property’s market value. While homeowners may get several different figures depending on who they use for a valuation, it’s crucial to understand how much you have to play with.

Measure Your Equity – In simple terms, the equity of your home is the term we use to describe the financial difference between your property’s market value, versus the balance of your mortgage. If you’re looking to upsize and you have a substantial amount of equity, you might be able to use this to purchase a second home without having to sell your first one.

Crunch The Numbers – Calculating whether you can afford to upsize is an important step in doing so, and you need to consider things like the costs and fees of selling property, how your lifestyle might change if you have to start paying a larger mortgage with bigger utility bills, and whether your current property valuation matches up to what you think it should be.

Long Term Vision – Many people opt to upsize with the vision of living in their ‘forever’ home. However, it’s still important to be pragmatic about the potential new purchase. Will your lifestyle be the same in ten years, will the home in question hold or grow in value, is it within desirable school catchments, or will your healthcare needs change in the future?

Cover All Of Your Options – While you’ve got your property thinking cap on, be sure to consider all possible options. Upsizing can be done in a number of different ways such as renovating, if you have the means and motivation to do so. Your situation may also allow you to keep your first home, and use it as a rental or investment property.

If you’re already the proud owner of one abode, it’s usually only a matter of time before your attention turns towards obtaining another. However, purchasing a second property is a lot different to your first, and for many it’s a much easier process if you know your way around how the world of real estate and the relevant finance works.

Should you be looking to sell your home or purchase a new one, enlisting the services of a free property advisor like ESPA can often be a game changer, and help you to make informed and educated decisions when it comes to the prospect of selling in 2022. As an example, your advisor would likely research the property, local agents, check the zoning, evaluate market conditions, and communicate clearly with you regarding all of your options – but where do you find one?

Take The Stress Out Of Selling Property

As a completely free service, Emergency Services Property Advisors provide property advisor services to Police, Fire, Ambulance and S.E.S personnel and their families right across Victoria.

Luke and the team at ESPA are passionate about providing support to some of Australia’s most valued public servants. Along with key industry insights, ESPA also works with a broad range of service providers linked to the real estate industry such as conveyancers, trades, legal practitioners and mortgage brokers.

If you are an emergency services worker looking to potentially buy or sell property in the future, please get in touch with Emergency Services Property Advisors today to discuss how we can turn your real estate dreams into reality, or call Luke directly on 0414 757 705.